Foreign Affairs published an article titled “ America’s Debt-Ceiling Disaster-How a Severe Crisis or Default Could Undermine US Power? The whole article is If the US can not resolve the Debt Ceiling issue, the US dollar will be lost privileges in international trade.

The Guardian published a recent article (Apr 30) titled: ” What is the US debt ceiling and what will happen if it is not raised? -The White House and Republicans in Congress are currently in a standoff over how much the government can borrow

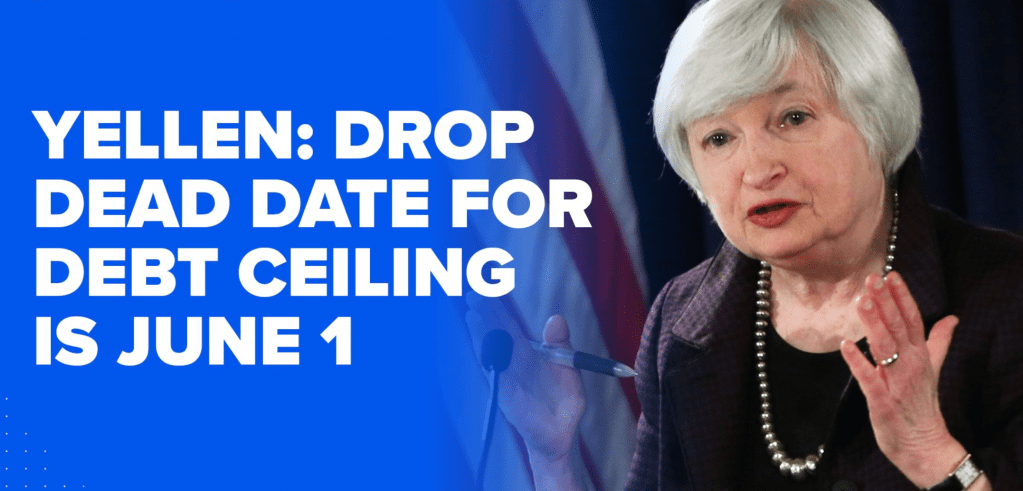

(AP) — Treasury Secretary Janet Yellen notified Congress on Monday that the U.S. could default on its debt as early as June 1, if legislators do not raise or suspend the nation’s borrowing authority before then and avert what could potentially become a global financial crisis.

In a letter to House and Senate leaders, Yellen urged congressional leaders “to protect the full faith and credit of the United States by acting as soon as possible” to address the $31.4 trillion limit on its legal borrowing authority. She added that it is impossible to predict with certainty the exact date when the U.S. will run out of cash.

What are the consequences if the US defaults on the Dept ceiling?

The consequences of the US defaulting on its debt ceiling would be severe and far-reaching, with potential impacts on the global economy. Below are some of the possible consequences:

- Interest rates would rise: If the US defaults on its debt, investors may lose confidence in the US government’s ability to pay its debts, leading to an increase in interest rates. This would have a ripple effect throughout the economy, making it more expensive for businesses and individuals to borrow money.

- Financial market instability: A default would likely cause significant disruptions in financial markets, with the potential for a sharp decline in stock prices, bond values, and currency exchange rates. This could trigger a global financial crisis, affecting markets and economies worldwide.

- Government shutdown: In the event of a default, the US government may be forced to shut down non-essential services and furlough federal workers. This could have a significant impact on the economy, as government spending accounts for a significant portion of GDP.

- Economic recession: A default could trigger a recession, as businesses and consumers cut back on spending in response to the uncertainty and financial instability.

- Damage to US credibility: A default would damage the US government’s credibility and reputation as a global economic leader. It could also harm the US dollar’s status as the world’s reserve currency, potentially leading to a decline in demand for US Treasuries and a loss of confidence in the US economy.

In summary, the consequences of a US default on its debt ceiling would be severe and far-reaching, potentially leading to financial market instability, higher interest rates, government shutdown, economic recession, and damage to the US’s global reputation and economic leadership.

How would a default affect the average American citizen?

A default on the US debt ceiling would have significant consequences for the average American citizen. Some of the potential impacts include:

- Higher interest rates: If the US defaults on its debt, it could lead to an increase in interest rates, making it more expensive for individuals to borrow money. This could impact everything from mortgages and car loans to credit card debt.

- Job losses: A default could trigger a recession, leading to job losses and wage stagnation. Businesses may be less likely to invest and hire in an uncertain economic environment.

- Reduced government services: In the event of a government shutdown, non-essential government services would be suspended, potentially affecting services such as national parks, passport and visa processing, and Social Security payments.

- Retirement savings impacted: A default could lead to a decline in the stock market, impacting retirement savings accounts such as 401(k)s and IRAs.

- Higher taxes: A default could lead to higher taxes as the government may need to raise revenue to service its debt and pay for essential services.

- Negative impact on the US economy: A default on the US debt ceiling could lead to a decline in the US economy, impacting businesses and individuals alike.

In summary, a default on the US debt ceiling would have significant consequences for the average American citizen, potentially leading to higher interest rates, job losses, reduced government services, retirement savings impacted, higher taxes, and a negative impact on the US economy.

How can individuals prepare for the potential consequences of a default?

It is difficult to predict exactly how an event like a US debt default would impact individuals, but there are steps that people can take to prepare for potential consequences. Some things to consider include:

- Build up an emergency fund: Having an emergency fund can help individuals weather a financial storm, whether it’s a job loss or a sudden increase in expenses. Experts recommend having three to six months’ worth of living expenses saved up in an emergency fund.

- Pay down debt: High-interest debt, such as credit card debt, can become even more expensive if interest rates rise. Paying down debt can help individuals reduce their financial obligations and minimize the impact of higher interest rates.

- Diversify investments: A decline in the stock market can impact investment portfolios. Diversifying investments, including holding investments in stocks, bonds, and other assets, can help mitigate some of the risks of a potential market decline.

- Consider refinancing loans: If interest rates rise, refinancing existing loans at a lower rate can help reduce monthly payments and save money over the life of the loan.

- Stay informed: Keeping up with news and developments related to the US debt ceiling and the economy can help individuals make informed decisions about their finances. It’s essential to seek out reliable sources of information and avoid making rash decisions based on speculation or rumors.

Leave a comment